Semantic Money® – Tagging money with intention

Fiat currency printed by governments or crypto-currency mined by computers. Spending rewards issued by credit card companies or retail brands. Impacts reports by socially responsible investment mutual fund families or foundations.

What characteristics differentiate these forms of money? Each has an accountancy focused on the math of input-output, with a sliding scale for the holder’s and user’s right of audit the money’s journey.

A hidden cost of using fiat and crypto-currency is this audit function. If you deposit money in the bank, where does the bank lend your money? Hard to tell. A bank’s assets are loans, what do the loans produce in contributions to the economy’s Gross Domestic Product (GDP), and how would a banker even answer the question? If you donate to a nonprofit, what of the range of needs in a region have they addressed and how should their impacts be matched up to the nonprofit’s leadership in tackling issues that range from primary to tertiary? As you look at all the ways that you handle money – saving, spending, investing, borrowing, insuring and donating – what is the net impact of your financial life, and how could you even answer the question?

With digital currency (fiat or crypto), the cost of auditing and the institutional blockers in answering “What is my money doing?” will disappear.

Urban Logic advises on (1) tagging digital money with its intended uses, (2) putting the money into circulation, and (3) receiving feedback as to the portions of the intention that are fulfilled or thwarted. Such semantic money® reduces the costs, delays and incompleteness of currently expensive institutional and private audit functions.

Imagine all of the elements of Quality of Life – education, energy, environment, health, infrastructure, public safety, governance, civil rights, and natural diversity, organized into clusters so their synergies could be strengthened and their interdependencies used free of institutional preemptions. (In collaboration with Stanford University, Urban Logic is creating such a Periodic Table of Quality of Life Elements).

The science of each Quality of Life Element is robustly dynamic, with daily advances in measuring and impacting physical, natural and social aspects of climatological, geological, structural, molecular and crowd phenomena. Improving health spans investing in health clinics, cleaner water, “Internet of Things” sensors and educating the population to be alert to personal exposure, vulnerability and resiliency to local toxins.

The funding of government programs or foundation grant programs often mixes four distinct gatekeeper activities: (1) identifying and quantifying the need of direct interest (a Quality of Life Element), (2) accumulating a pool of financial and social assets to address the need, (3) overseeing a portfolio of investments in specific strategics to meet the need, and (4) returning to phase 1 to report changes in the need as a result of the strategies funded in order to acquire additional assets (phase 2) and invest them (phase 3). This Gatekeeper’s Business Model of change is proving slow, inauthentic and artificially narrow, in part, because of its inherent conflicts of interest: Few investors would expect a mutual fund manager to self-generate a performance metric for return on portfolio that ignored performance relative to the major stock exchange indices. Semantic money reduces the Gatekeeper frictions and could speed objectively ranking, funding and seeing the impacts of Quality of Life strategies.

Requesting Our Semantic Money® Services

Urban Logic’s successful innovation strategies depend on prototyping and collaborative services offered to companies, financial institutions and government organizations that inform and seek our “systems-of-systems” approach.

Urban Logic’s Semantic Money methodology offers its collaborators:

- Consultation and consultative reports and lenses on credit scoring, quality and risk modeling for finance, investments and insurance,

- Strategic insights and information on how to harness and aim corporate, community, environmental and government change,

- Consumer-product and crowd-sourced knowledge on tracking and improving supply chain and product lifecycle impacts on regional quality of life concerns,

- A new conversation promoting the interests of people concerned with health, community and environmental sustainability issues via a virtual currency of true value and meaning

For more information about Semantic Money, please contact us at info@urbanlogic.org.

Adding your voice

As a nonprofit, Urban Logic is keenly interested in hearing your thoughts on developing its core technologies, like Semantic Money.

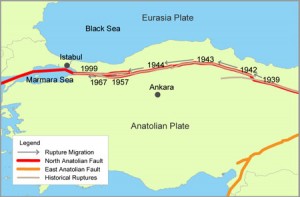

Mitigating risk and expediting recovery in disaster-vulnerable regions, including mapping, planning, phasing and organizing investments, philanthropy and other interventions pre- and post-disaster requires a continual conversation 24/7, 365 days per year.

Please share your thoughts on Semantic Money as Comments to this page.

Regarding regional quality of life (QoL) impacts by comparing alternative economic, environmental, social and other investments and interventions, we especially welcome suggestions for

- sources of historical, evidence-based QoL data on a regional or national basis

- QoL visualization analogies, concepts and dashboards

- QoL scoring and ranking of intervention options

- QoL mitigation strategies